- HOME

- NEWS

- THE VISION

- VEDIC SCIENCE

- MEDIA GALLERY

- ABOUT US

- DONATE NOW

- Fundraising Director’s Message

- DONATE NOW

- Donation Details / Pledge Payments / Contacts

- Russian Donations Details

- Bank Transfer Details

- Donate in Crypto Currency

- Donor Account Dashboard

- Donation Hotlines

- Save Dharma Campaign

- Donor Lists

- Our Trustees

- 31 Dresses Campaign Donors

- Diamonds of the Dome Donors

- Doors of The Dhama Donors

- Rooms of Worship Donors

- Steps of Surrender Donors

- Pillars of Devotion Donors

- Nrsimha Sponsorships Donors

- Prabhupada Murti Awards Donors

- Medallion Seva Donors

- Gratitude Coin Donors

- Brick Donors

- General Donors

- Financial Reports

- FCRA Reports

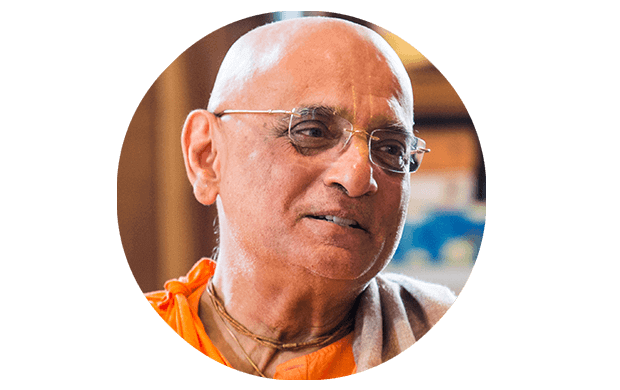

BHAKTI CHARU MAHARAJA SEVA – INDIAN RESIDENTS

Disclaimer: This sponsorship option is not connected in any way to raising funds for the samadhi of His Holiness Bhakti Charu Maharaja.

ATTENTION: When offering your donation, please make sure to select the right country payment gateway and currency type so you can be provided with the proper receipt for your tax purposes.

PAYMENTS BY CHECK AND WIRE TRANSFER: To make payments by check go to Donation Details page. To make payments by bank wire transfer go to Bank Transfer Details page.

This donation option is set up for auto-withdrawals for recurring payments towards your pledge. Sponsors will receive a specially molded imprint of Bhakti Charu Maharaja’s lotus feet which will be shipped to you. Sponsorship also includes the Sahasra Jal Abhisheka.